SCB LEGAL

We help our clients become wise to any consequences we can foresee in off the plan contracts.

Contracts for off the plan purchases are far more detailed than other property sales contracts. It is far harder to negotiate with a developer than with any other residential sale process.

In our work as conveyancing lawyers, we are aware of the many ways in which people can be disadvantaged if they do not have their contracts reviewed by an experienced solicitor with a detailed eye, that can potentially create significant issues.

When our team reviews off the plan residential contracts – homes, apartments and home and land packages – we know how people can get caught out.

Importantly, always keep in mind that any contract given to you is designed to be in the favour of the person or business that provides it to you. By having the contract reviewed, we can identify if there are any potential risks to you, alert you to them, and then you can make an educated decision about whether you wish to proceed with the purchase or sale.

Unfortunately, we observe that many sales agents are happy to allow buyers to sign the contract for an off the plan property without having sought legal advice. This can create significant issues that often only become obvious to the buyer later on, when nothing can be done to rectify it.

There are a number of red flags that we commonly find in off the plan contracts for homes, apartments and house and land packages.

Typically they relate to:

Notoriously, the ‘sunset clause’ is something to specifically watch out for in off the plan contracts. It is well publicised that sunset clauses allow for off the plan contracts to be cancelled, if the developer does not have the property completed by the sunset date. It is an angle that is pitched as a safety net or a positive, when in fact, it can be very problematic.

Generally, the contracts allow for the builder/developer to notify you of any delay to the completion date within a certain time period. If that occurs a few times over, you may not be able to move in for 3 or 4 years. Sometimes sunset clauses allow the developer to extend the completion date endlessly.

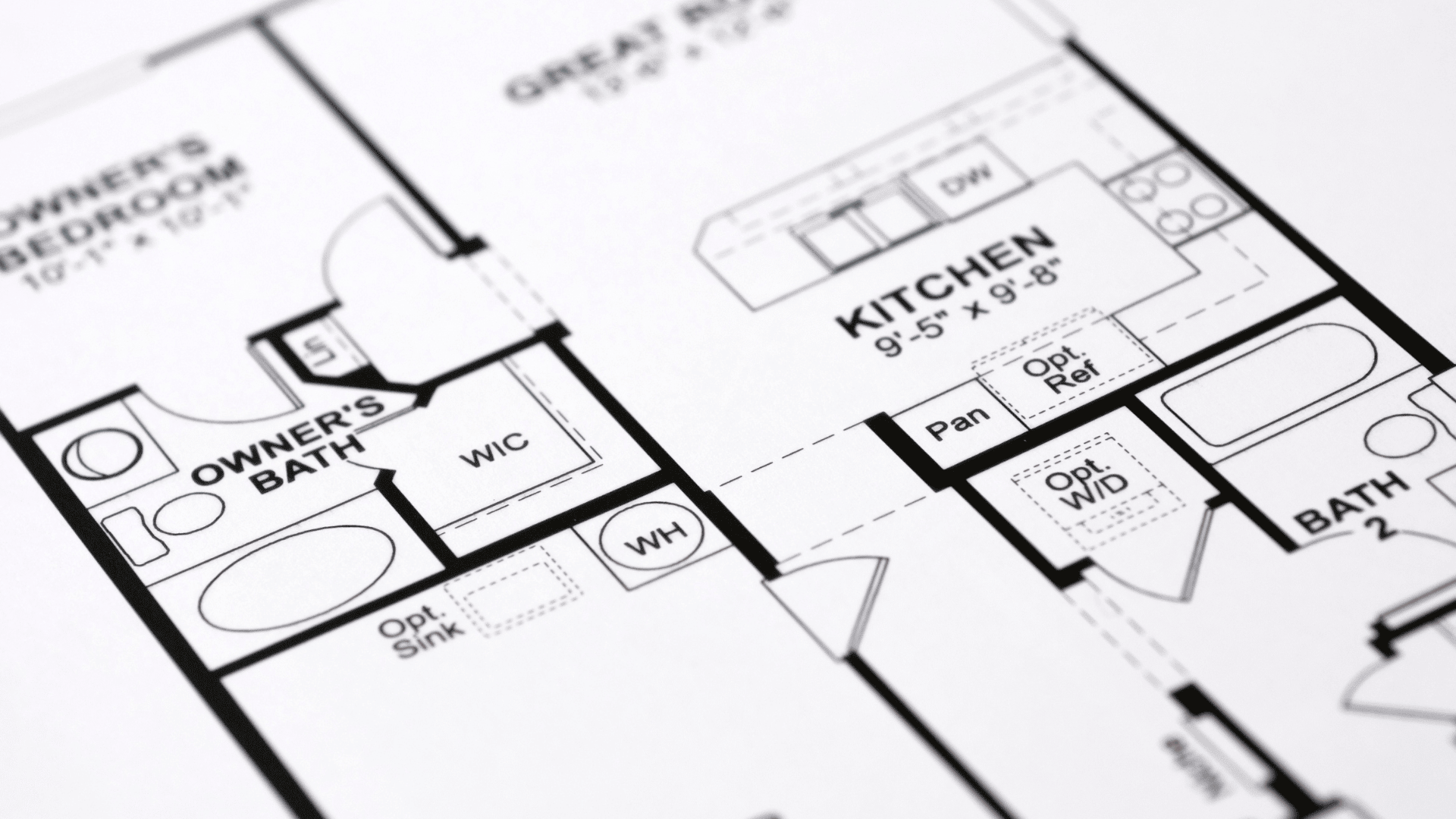

The financial risk is more significant for off the plan home and land packages where there are two contracts – one for the land and one for the building.

These issues come up more than you might imagine. Whether you are looking at a house and land package or a unit or apartment, it can be very exciting looking through the display and imagining yourself there, or owning it and renting it out. However, you need to ensure that you will end up with what was pitched to you.

Contracts in these situations are usually more favourable to the developer. They will often allow for ‘variables’ that you will want to be alert to.

The wording that is used in contracts often allows for great flexibility for the developer, which is not always good news for you.

After reviewing the contracts, our team has been able to help people avoid:

Imagine paying the mortgage repayments on a property that you cannot move into? Or, that is not even built yet!

Issues like these are what highly experienced property lawyers and conveyancers will pick up in your contract and alert you to. While it’s not always the news our clients want to hear, they are always happy that they had us review their contract before signing. They’re also pleased they are alert to the possible implications, and armed to make a decision about whether they are confident to move forward or not.

Looking for something else? Click on the title below for more information.

You should be able to be confident about any off the plan property purchase you are making. Before you buy off the plan, have our team review the contract, and avoid getting caught out.

Buying a home or investment property should be an exciting and positive experience. Let us help you and ensure that feeling can stay that way.

OFF THE PLAN CONVEYANCING SYDNEY

Our team reviews contracts to identify any potential issues an off the plan purchase may create for you.